Fintech and Banking

Software Development Services

Being a fintech software development company, we combine financial expertise with innovative technologies to deliver outstanding fintech solutions. We help the financial services sector manage risk and unlock Big Data’s potential – with advanced analytics, Machine Learning and more. In order to become more competitive and profitable, banks and financial institutions are required to follow regulatory guidelines, provide sophisticated client-focused services and have flexible operations. Turkey Software has a range of award-winning and market-tested banking software solutions that provide an innovative and competitive approach for Banking operations.

We provide custom software solutions and related services to financial and fintech organizations, including banks, credit unions, and all types of enterprises that look to establish effective, digitally-enabled financial processes. The fintech ecosystem is growing rapidly and unites thousands of solutions for payments and transfers, lending and financing, insurance, financial management, markets and exchanges. Our team has experience providing fintech software development services by implementing both ready-made solutions and custom apps. We not only deliver innovative software products, but also ensure professional tech advisory and support to manage changes to architecture that arise after implementation.

- Custom Fintech Development

- Fintech Mobile App Development

- Fintech UI/UX and Web Design

- Digital Banking Services

- Fintech Payment Solutions

- Data Analytics in Fintech

Banking and Financial Software Development Expertise

Secure software solutions to enhance user experience in the new, digital landscape - From simple mobile payment apps to complex enterprise-grade financial platforms, we offer our in-depth fintech expertise, first-class specialists, and effective customer-oriented approach to help our clients on their way to digital transformation. Having almost 4+ years of experience in banking and financial software development, we create new or improve existing financial solutions for our customers. We are ready to analyze the market and build an effective fintech solution for your business. Here is what we offer:

- Fintech Big Data Solutions

- Electronic Trading Platforms

- Blockchain and Cryptocurrency Solutions

- Financial Planning and Management Solutions

- Fintech Payment Solutions

- Staff Augmentation

FinTech

Software Solutions

-

Fintech software development

We create financial software from scratch as well as enhance deployed solutions or their components.

-

Fintech software security and compliance

We ensure the stable operation and protection of financial systems along with the data they process.

-

Fintech software integration

We make financial solutions part of bigger software ecosystems or integrate them with third-party systems.

Go digital to lead in the banking sector

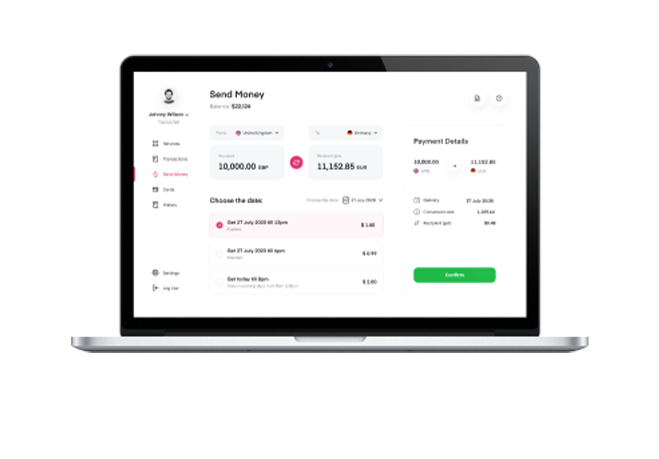

Deliver industry-leading service: We'll help you deliver exceptional service, through improved operational efficiency, lower transaction fees and the diverse payment options enabled by blockchain technology. Our custom software solutions and R&D support help you manage your data and track performance and attribution.

Protect assets against fraud: Fraud and identity theft are among the biggest challenges faced by modern financial institutions. Our custom Fintech solutions help tightly regulated finance, banking and insurance businesses create secure storage and transfer – via blockchain technology – without any third-party involvement.

Unlock data insights: Our data analytics expertise will help you collate and analyse your data, in a user-friendly environment. We'll enable you to understand insights in real time, so you can build your business around the information contained within your data.

Speed up payments, reduce costs: In today's financial market, everything moves at pace. We'll help you integrate blockchain technology to ensure your transaction speed doesn't falter. You'll be able to safely transfer and accept global payments within minutes, 24 hours a day, while saving on peer-to-peer transfers and international remittances.

Manage complex financial risks: Our custom Fintech solutions help you develop risk prediction modelling tools to calculate operational risks, in real time. So you can manage major credit, market and operational risks both time and cost effectively.

Specialized in Solid End-to-End Delivery of Tailor-made Technology Solutions

- AI/ML

- Computer Vision

- Blockchain

- Embedded Software

- IoT

- Automation and Robotics

- Content Distribution

- AR/VR/MR

-

AI/ML

Solutions delivering analytics, product recommendations, cognitive computing, and predictive analytics.

-

Computer Vision

Solutions for object, movement, pattern recognition, object tracking, video content analysis.

-

Blockchain

Solutions for securing verifiable transactions, maintaining and tracking transactional data, analyzing transaction flow and wealth distribution.

-

Embedded Software

Creating software for machines and devices - wearable gadgets, appliances, industrial machines, etc.

-

IoT

Consumer gadgets, smart home healthcare solutions, computer numerical controls, DSP and network solutions.

-

Automation and Robotics

Solutions for remote process control, equipment monitoring, production line automation; electronics driven by firmware, MCUs, sensors, and algorithms.

-

Content Distribution

Smart TV solutions, video capturing and processing software, media content distribution systems, instant messengers with video sharing features, and interactive video conferencing solutions.

-

AR/VR/MR

Business and game apps facilitating knowledge-sharing, employee onboarding, field service management, and immersification.

-

Tech Engagement

-

Software Innovation